Did the world really need yet another mutual-fund gimmick? The Liberty Investment

Group seems to think so: it’s launched something called the Index

of Economic Freedom Portfolio to no little acclaim. Here’s Mark

Skousen:

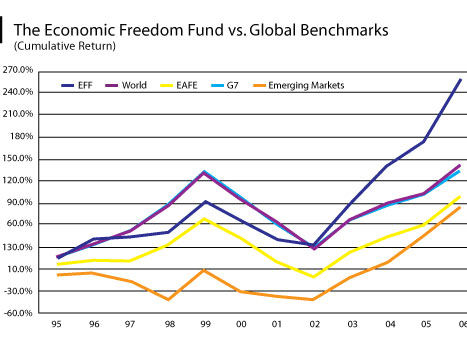

Spath and Kirkscey back-tested the performance of their index and came to

a startling conclusion: Over the past 11 years, the Economic Freedom Portfolio

has far outperformed world stocks in general. While the MSCI World Stock Index

rose 140% during this time, and the Emerging Markets Index climbed 85%, the

IEFP rose an astonishing 254%. See the graph below.

I have no idea where this chart came from, but it makes no sense to me. There

are two big oddities:

- The lines all start at different points. Shouldn’t they all start at the

same point? (The chart is meant to show returns over 11 years, not over 12

years.)

- The horizontal lines look evenly spaced, but the markers on the y-axis are

all over the shop, with the 0% line marked as 10%, and the 30% line marked

as 130%.

I tried to look at the fund’s prospectus

for insight as to how this chart was calculated, and came up with nothing. Skousen

says that

The Index of Economic Freedom Portfolio (IEFP) is updated each year, according

to the Heritage/WSJ annual index.

And Stephen

Kirchner goes even futher:

First Trust Portfolios LP has launched a fund that tracks the Heritage Foundation/WSJ

Index of Economic Freedom.

Not true. The fund for sale now is the "Index of Economic Freedom Portfolio,

2007 Series" – which means that you buy and hold a bunch

of securities from 17 countries which came somewhere near the top of the index

in 2007. The Portfolio never gets updated: if a country falls out of the index,

its stocks stay in the fund, and if a country makes it into the index, its stocks

will never make it into the fund. If you wanted to track the index, you would

need to sell the 2007 series when the 2008 series was launched, and so on –

paying large up-front fees each time.

And I have no idea what this means, from Skousen:

In 1995, the IEFP consisted of only 6 countries. Now there are 17 countries

in the portfolio. Clearly, economic freedom has been expanding around the

globe.

There might be 17 countries in the portfolio, but there are no fewer than 30

countries ranked

"free or mostly free" by the Heritage Foundation index. And it’s not

the top 17 countries which make the cut, either. Estonia, for instance, comes

in 12th on the index, but isn’t in the fund.

So when the fund managers created their pretty chart, did they take returns

from the IEFP, which started off with 6 countries and now has 17? Because if

they did then they’re charting returns from a dynamic portfolio of stocks, which

changes according to the freedom index – and it’s a bit misleading to

then use the returns of that dynamic portfolio to sell a fund which is entirely

static and never changes.

On the other hand, did they just take the 17 securities in the 2007 series,

and see how they’ve performed over the past 11 years? That wouldn’t be much

of an indication of anything, and it’s probably not surprising that the fund

did well over the past 11 years, since the Finland chunk is invested 100% in

Nokia, while the New Zealand chunk is invested 100% in New Zealand Telecom.

Amazingly, both stocks have done very well over the past 11 years: what a coincidence!

Hilariously, they’ve even decided that in order to represent Luxembourg in

their fund, they’re going to invest 100% in Tenaris, which is really more of

an Argentine company than a Luxembourgish one. In any case, Tenaris is a very

multinational company, dependent wholly on the oil industry, which has done

very well in recent years (of course), but which has almost no connection to

economic conditions in Luxembourg.

The Index of Economic Freedom Portfolio is a joke, and I sincerely hope that

people don’t go piling into it based on misleading information from places like

"Investment U". If you really want to bet on the Heritage Foundation

index, take the top 7 countries, ranked "free", and buy the five countries

where there are ETFs based on their stock markets. I’ll even give you the ticker

symbols: EWH (Hong Kong), EWS (Singapore), EWA (Australia), SPY (USA), and EWU

(UK). New Zealand and Ireland are too small to worry about. There – I’ve

just saved you a 3.95% sales charge.