A friend of mine is shopping for a mortgage right now, and I just had a very

frustrating conversation with her mortgage broker. What I’d like to do is be

able to choose between a fixed-rate mortgage and an adjustable-rate mortgage.

If I take the adjustable-rate mortgage, I expect to pay a lower interest rate

in return for taking on interest-rate risk. But it seems that the only ARMs

on offer are all "teaser rate" products, where the mortgage resets

to a significantly higher spread once the initial teaser period is over. And

even the teaser rates, on closer examination, don’t look particularly attractive

compared to the fixed-rate mortgage on offer.

The broker offered three ARMs to my friend: a 7/1 ARM at 6%, a 5/1 ARM at 5.875%,

and (after I asked about it specifically) a 1/1 ARM at 5.75%. All three of them,

he said, reset to 225bp over one-year Libor at the end of the initial period.

The reason I asked about the 1/1 ARM, of course, was to get an idea of what

happens to the spread over Libor. At the moment, 1-year Libor is 4.47%, which

means that the 1/1 ARM starts off for the first year at 128bp over Libor, and

then jumps all the way up to 225bp over thereafter. If one-year interest rates

stay where they are, that means my friend will be paying interest of 6.72%.

Even the 30-year fixed-rate mortgage is much lower than that: just 6.125%. And

of course my friend would be paying well over 7% once one-year rates go above

4.75%, which is entirely possible.

The broker was quite clear that you should never buy an adjustable-rate mortgage

with an intial rate any longer than the amount of time you intend to own your

home. If you’re going to sell within five years, then get the 5/1 ARM: it’s

cheap money. But if you’re intending to stay in your house and pay off the mortgage

over time, then don’t even think about it: you’ll be killed once that adjustable

rate of 225bp over Libor kicks in.

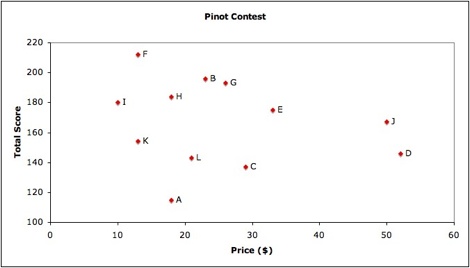

Libor doesn’t go out beyond one year, but Treasury rates do; the one-year Treasury

trades today at 3.49%. So let’s look at spreads over Treasuries

as opposed to spreads over Libor: that way we can compare all the options on

a like-for-like basis. And let’s assume that 225bp over one-year Libor is the

same as 323bp over Treasuries.

| Product |

Initial spread |

Spread after reset |

| 1/1 ARM |

226bp |

323bp |

| 5/1 ARM |

216.5bp |

323bp |

| 7/1 ARM |

210bp |

323bp |

| 30yr fixed |

158.5bp |

N/A |

This is just incredibly counterintuitive to me: the spread curve on mortgages

seems to be pretty steeply inverted. The more-floating and less-fixed the mortgage,

the higher the spread is – even before you take into account the seemingly-penal

interest rate once the initial period is over. Are these numbers remotely similar

to the ones that Alan Greenspan looked at when he famously said that adjustable-rate

mortgages made more sense than fixed-rate mortgages? How can it make sense for

adjustable-rate mortgages to reset to 323bp over Treasuries, while a 30-year

fixed-rate mortgage for the same borrower is quoted at 158.5bp over Treasuries?

Indeed, looking at this table, even the initial rates offered on the ARMs look

pretty underwhelming: they’re "teaser rates" only in comparison to

the really high rate charged after they reset. If anybody can provide

an explanation of what’s going on here, I would be extremely grateful, because

I can’t make heads nor tails of it. Why is it that a borrower pays more when

the borrower is taking interest-rate risk than when the lender takes interest-rate

risk?

Update: The fixed interest rate on a 15-year fixed

rate mortgage is 5.875% – the same as the teaser rate on the 5/1 ARM.