The world is full of people desperate to know what Gretchen Morgenson thinks about the market in mortgage-backed securities, or MBSs. The problem is that her column last week on the subject is hidden behind the Times Select firewall. So we can all be very grateful that she has now rewritten it, at even greater length, and republished it under a “News Analysis” slug. (No firewall!) The headline? “Crisis Looms in Market for Mortgages“.

Or, you know, we can ignore it, on the grounds that Morgenson adduces no evidence whatsoever that any crisis is looming at all. For one thing, she doesn’t seem to understand the difference between two entirely different types of investment: equity in subprime mortgage originators, on the one hand, and debt backed by pools of subprime mortgages, on the other. It’s certainly true that originating subprime mortgages does not seem to have been a very good business to invest in over the past year or so. But Morgenson never connects the dots and explains why that means that the market in subprime MBSs is likely to implode.

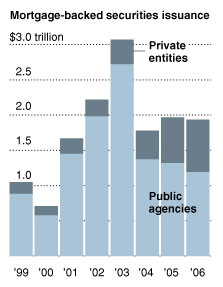

Morgenson also talks at great length about the enormity of the market in MBSs, but never stops to point out that the vast majority of that market is in bonds issued by Fannie Mae and Freddie Mac, and that no one has any worries whatsoever about those securities crashing.

Here’s a bit of typical overheated prose:

Wall Street firms and entrepreneurs made fortunes issuing questionable securities, in this case pools of home loans taken out by risky borrowers… Regulators stood by as the mania churned, fed by lax standards and anything-goes lending.

But here is Morgenson’s own graph, showing the practical effects of that churning mania: MBS issuance more than $1 trillion lower in 2006 than it was three years earlier. It’s very hard to look at this graph and see any evidence of a bubble: rather, it seems that private-sector MBS issuance has been rising only to make up for a large drop in issuance from Fannie and Freddie.

But here is Morgenson’s own graph, showing the practical effects of that churning mania: MBS issuance more than $1 trillion lower in 2006 than it was three years earlier. It’s very hard to look at this graph and see any evidence of a bubble: rather, it seems that private-sector MBS issuance has been rising only to make up for a large drop in issuance from Fannie and Freddie.

Morgenson’s most substantive problem is that there’s a ticking bomb in the MBS market, in the form of investors failing to mark their securities to market. First she says they don’t, then she says they do, and then she says they don’t — let’s see if you can make more sense of it than I can.

Owners of mortgage securities that have been pooled, for example, do not have to reflect the prevailing market prices of those securities each day, as stockholders do. Only when a security is downgraded by a rating agency do investors have to mark their holdings to the market value. As a result, traders say, many investors are reporting the values of their holdings at inflated prices…

Years ago, mortgage-backed securities appealed to a buy-and-hold crowd, who kept the securities on their books until the loans were paid off. “You used to think of mortgages as slow moving,” said Glenn T. Costello, managing director of structured finance residential mortgage at Fitch Ratings. “Now it has become much more of a trading market, with a mark-to-market bent.”…

Interestingly, accounting conventions in mortgage securities require an investor to mark his holdings to market only when they get downgraded. So investors may be assigning higher values to their positions than they would receive if they had to go into the market and find a buyer. That delays the reckoning, some analysts say.

Of course, Morgenson is missing two crucial points here. The first is that here simply isn’t a market in most MBSs tranches — that’s why so much of the recent activity has concentrated on MBS indices rather than the underlying securities. The liquid, mark-to-market activity that Costello is talking about is entirely in Fannie and Freddie bonds, not in individual tranches of securitized subprime mortgages. You can’t mark subprime MBS tranches to market daily for the very good reason that most such tranches simply don’t trade on a daily basis.

And the second point is that if you actually look at the prices for those subprime MBS tranches when they do trade, guess what? They haven’t actually fallen much in price at all. If investors were marking to market, it really wouldn’t make much difference. As Josh Rosner told me, the problem is not that existing MBSs are likely to default or drop in price. A default is much like a prepayment, from an investor’s point of view, so investors only really care about default rates when they start approaching prepayment rates. And they’re nowhere near those levels.

Anyway, here’s my favorite bit from Morgenson’s article. Before you read it, ask yourself what a scary loan-to-value ratio for subprime mortgages would be. 125%? 100%? 95%?

The rapid rise in the amount borrowed against a property’s value shows how willing lenders were to stretch. In 2000, according to Banc of America Securities, the average loan to a subprime lender was 48 percent of the value of the underlying property. By 2006, that figure reached 82 percent.

There you go: 82%, in the year universally considered to be the laxest year in the history of subprime mortgages. Now do you understand why investors aren’t particularly worried about default?

Invidiously, Morgenson even hints darkly at nefarious conflicts of interest at the ratings agencies, saying that they might be soft-pedalling downgrades to save their own hides. I don’t think they are. Mortgage pools are designed to be able to withstand a temporary drop in house prices or rise in default rates. I look at the tiny number of MBS downgrades and take comfort in it. I’m perfectly happy to concede that subprime mortgage originators who were active this time last year are going to be in a lot of trouble now. But I’m nowhere near convinced that there’s any real problem in the market for the securities based on the mortgages they originated.

Yea, a poor piece all round. A tad harsh on the Bear Stearns equity analyst as well. What was his crime? – not being clairvoyant enough to be able to foresee a criminal investigation of New Century.

And yes, Gm never addresses a) just how many bonds are affected or could be as a %age of subprime/ Alt-A total; or b) what loss levels have to bleed thru for the pain to register at all.

I’d take issue with you on how subprime bonds have traded, though the effect is still pretty small – many of the 2006 triple-B and triple-B minus bonds are down in the 500-800bp range, way out from 200bp or so before the crisis.

Many of these are bought by CDO funds, which usually don’t mark to market. Some by hedge funds, which do m-to-m. So any pain so far is entirely dependent on how geared up the HFs were.

But since these tranches are small parts of the capital structure, I don’t see much more than localised pain – unless a hedge fund went super-long on all the bad bonds, and their single-name default swaps, was super-leveraged and is now selling all over the place to cover margin calls. In which case, we’d be hearing about it right about… two weeks ago?

So what’s the excuse of the poor analyst slobs who rode the New Century rocket all the way into the ground and didn’t get around to marking it down to sell until, um, this morning, eh Murray? The jury still out?

Awww, someone wants to tar everyone with the same brush, ‘cos that makes life easier for the dummies… I was talking about the Bear Stearns analyst, angry one. Just him. Pay more attention when you read.

I read some articles by which you try to disdain all those who think the bottom in the real estate has not been reached. You focus only in the errs but you do not present a case favoring this sector. The ratio loan to value for subprime mortgage seems to me a mistake, if the loan in case is a subprime one, that ratio was 48 to be nowdays 82%. Come on! Those people can not afford a normal installment and they could make a huge downpayment.It is absurd.

Felix:

I don’t understand your point about mark to market accounting. Investments can be classified as a) Held to Maturity b)Available for Sale or c) trading. If previously these MBS sec were classified as HTM then no mark to market accounting is required, write-downs are only necessary when the security is impaired. IF investors start treating the MBS sec as “Trading” securities then they do need to mark to market. As to the second point FASB doesn’t require daily market prices to apply fair value accounting, and it is difficult to believe that traders don’t know the fair value of their portfolios on a daily basis. If not how are they doing the value at risk analysis at the end of each day/week?

The concern with the 82% loan to value ratio is whether the value is really there. At 48% if the value of the property was 20% off – no problem, but at 82% (and remember this is the average, all those 48% loans are still in the calculation) there probably should be some concern.

Don, interesting point about the LTV — although this is the average LTV for new loans, so the old 48% loans are not included. My guess is that in 2000, subprime lending was generally made up of people who were consolidating high-interest credit-card debt and the like into low-interest secured debt. Whereas in 2006, subprime lending had become a real mortgage game.

Thanks for the response, do you have an idea about what the average cost of foreclosure is for a bank (as a percentage of market value)? I have heard as high as 20% (making the 82% figure more concerning).

I just came to your blog from a link at CNN Money and have enjoyed a number of the entries, I look forward to more of your thoughts.

Don

Regarding the LTV issue, I think it may be important to denote LTV from CLTV. If the new sub-primes are 82% LTV and 95% CLTV, we have a problem gentleman.

I guess todays numbers on the markets tells you your story. Refering to Psycologists indeed.

Don: Some rough estimates for foreclosure costs of a single family residential property:

Non payment of interest: 6-18 mos est: 9%

Real estate sales brokerage costs : 6%

Repair/maintenance costs: 7%

Legal/appraisal/title : 3%

Taxes/prop.insurance/misc.taxes: 5%

Loss in value as an OREO/foreclosure: 10%

____

Peter B. TOTAL 40%

Have see # as high as as 98% in last real estate recession in the 1990s..

Rapidly rising real eatate market values, home buyers eager to make a purchase to get in on the action or secure a home before it was out of reach, either way no cash down, and variable interest rates. And Wall Street becoming ever so creative in financing this commodity we call a mortgage.

All of which is now riding on the Titanic waiting for the iceberg, or has it hit already? Greed has driven this market upwards and fear will drive it down.

I have been finacing real estate since 1968 when you needed real money down, 20-25%, have a real verifiable income and credit beyond reproach. VA and FHA loans were the subprime lenders of the time.

It kept the real estate market moving slowly for the demand yet to come. There were always periodic credit crunches which were really cash crunches. To much demand and no cash availablity at the Banks. You got approved and then waited for funding in 1, 2, 3, 4 weeks, really!!! I used to call the funding desk for a funding date on loans in LA while working for Security First Bank later Security Pacific National Bank for those that remember.

The notion was born in the 70’s that a mortgage could be transformed from a heterogeneous product into a homogeneous product. Fannie and Freddie were born in the 70’s to create that process and securize the funding. Just in time for the increased demand of the baby boom market.

It’s the boomers, always the boomers, which I am one of, class of ’46.

But it worked. Banks and S&L’s were able to make and sell mortgages in a organized market and Wall Street participated in that process.

Like so many kernnels of corn in a basket mortgages like all other commodity products could be freely traded, bought sold, optioned, traunched, etc.

Once the commodity was understood the Banks and the S&L’s, those that remained after the melt down in the late 80’s and early 90’s, saw the market mature. By the mid 90’s the mortage origination industry – mortgage brokers, and companies purchasing mortgages to re-package to Wall Street – mortgage bankers, replaced the Banks and S&L’s. (But the mortgages were underwritten to Fannie or Freddie standards.) In some years up to 80% of the mortgage originations were done by mortgage brokers.

After 2000 the stockmarket meltdown and the money that was salvaged still needed a home. Real estate was rising from the doldrums and money was sitting idle looking fo a home, your home!!!

Like all mature markets competion began to heat up. The more competative the mortgage market for A paper became more creative products emerged, the B & C – subprime paper, and competion forced ever more innovation. I don’t know who was the chicken and who was the egg in creating these products. But between unregulated lenders – mortgage bankers and Wall Street the race to become the biggest of the subprime lenders was on. Because on Wall Street size matters.

Buy-back agreements on mortgages are as dumb as car dealers signing recourse agreements on car contracts they sold to the banks in the 70’s. When you really need them they are never available. I own a mortgage company and the mortgage bankers wanted me to sign buy-back agreements on the mortgaes we brokered. I told them the company would sign but what would they do with my used furniture and computers. We were a service company; a few sq. ft. of office, some second hand furniture and a computer or two and we were in business. Now with that many subprime companies folding are they going to flood the used furniture market like what happened after the dot com bust.

The products from the Mortgage Banking firms and Wall Street became laughable. “Fog a mirror and get a loan”; “if you have a pulse” you can get a loan or “apply now before you home value goes down even more”. All 3 mortgage ads heard on on KCBS radio in San Francisco in the fall of last year.

Where were the bank or mortgage regulators and/or the SEC.

In any lending situation the ball comes bouncing back to you at the worst possible time in the worst posiible condition.

LTV’s in the final analysis is all the protection a lender has. The walk away factor of high LTV’s is HIGH!!! A 90% LTV is really a 100% loan at a minimum and more likely 110% LTV or more, ONLY if the market value remains the same. If your LTV is even higher hang on for the ride. The lender gets stuck with foreclosure costs, real estate sales commissions, property taxes, insurance, unpaid interest not to metion fix up for resale.

In California a purchase money mortgage for a 1-4 single family owner occuppied residence the collateral is all the lender has, it is non-recourse paper!

The melt down in Subprime to me was not unexpected, greed drove the market to become ever more creative. How could it sustain itself!!

Unwinding this market is going to be painful and going forward current home owners and future borrowers are going to pay the price of the irrational enthusiasm of the mortgage market.

Lastly, I apologize for the typo’s, grammar and spelling!!! John G.

John G.,

Perhaps you should mention that the subprime “meltdown”, as you put it, is largely the result of poor ethics and a clear lack of accountability among mortgage brokers like yourself. It’s no coincidence that the major players who are now on life support have one thing in common, they are primarily wholesale lenders and, despite their overly aggressive subprime agenda over the past five years, they rely on your integrity and guideline compliance to fund loans that will perform. Unfortunately, responsible subprime lenders with more diverse channels of originations and more stringent underwriting practices will suffer right along with you as the investors are unlikely to discriminate when these loans go to market.

Mike:

Not to sound self serving, I am not a subprime broker, never have been, never will be. I stopped making residential loans in 1987, just commercial real estate loans and private real estate investments.

I beleive there are very ethical brokers and mortgage bankers in the industry. It is usually a few minority bad actors that forces change on the majority. In this case thought, for reasons yet to learned, that the minority are some of the largest players in the industry.

I agree however with your comments regarding broker ethics in processing loans. But as a observer of the industry the mortgage bankers throught their own sales force of “Loan reps” encourged un-ethical behavior.

The pressure to fill loan commitments where hugh. It was always interesting to see the activity at the end of the month. Lenders lowered their loan underwriting standards, looked the other way and either lowered their loan pricing or increased commissions to brokers to encourgage more closings before month end. All to fill a expiring mortage backed security commitment.

Un-ethical behavior within the industry was similar to the behavior which caused the melt down of the S&L industry. Greed.

If you look at the compensation structure of the industry it is wholly comission based, the more volumn you produce the more you make. It is a volume driven business in which volume gets rewarded. The classic sales conflict for most business is sales vs credit quality (think sales vs. accounts reciveabe for most business). Making a sale is important to being profitable – collecting on the sale – account receivable assures profitability.

In the mortgage brokerage business the sales risk all pass throught to the last guy holding the bag, He is the one that gets burned, so as an industry, Broker, Banker or Wall Street, it is stricitly sell, sell, sell with little or no accountability or consequences.

If you mix greed and promote unethical behavior bad things are bound to happen.

It is the ethical players who will have to pay the price and bear the burden of those who thought it would never catch up with them.

Got to go look at some real estate, sorry again for the typos, grammar and spelling, John G.

Gretchen Morgensen was correct

Good column Felix.

FINANCIAL LOAN OFFER HERE:

Are you in desperate need of funds?

Do you desire a house or a car but lack the finances to acquire it?

Are you in need of funds for your real estate business or project establishment?

Have you been turned down by other lenders?

Are you in need of funds to pay all your bills or for your child education?

Lloryd Wood Lending firm is granting you the opportunity to actualise your dream.If you are interested in a loan of any form,kindly contact us through the below email address for your loan request.

llorydwood@yahoo.com

APPLY FOR YOUR LOAN NOW.

This is Ralph Alexandria international lending firm.We offer both real estate loans,business loans,establishment loans,personal loans,Educational and debt free loans,Agricultural loans,mortgage loans e.t.c to interested persons for any purpose.

Are you in need of funds for your dream project or housing?

Do you need funds for your real estate establishment or mortgage?

Have you been turned down by the bank or other lenders?

Do you need funds for your business or Agriculture?

Do you need funds for your child Education or to pay your bills?

Ralph Alexandria lending firm is granting you the opportunity to actualise your dream.If you need a loan of any type,do contact us through this email address for your loan requst:

alexandriaralph@yahoo.com

Are you tired of Seeking Loans and Mortgages,have you Been Turned down constantly By your banks and Other

Financial Institutions,We Offer $5000 min to $50million usd max,you have to be 18yrs and older to apply,reply

now via email (iwantaloan2009@yahoo.com.hk),We give out loans to all categories of people, firms, companies,

schools, churches, industries etc. we give out loans at very cheap and moderate rates,We are trusted,reliable

and dynamic.contact us now…Hurry Up and get this Unique Opportunity Everyone is talking about. please respond

Via only Email: (iwantaloan2009@yahoo.com.hk),For the first 7applicants,they get their loan at 3%.Hurry Now.

Determine whether you fit into any of these categories:

You need other financing options than an SBA loan, Bank loan or Hard Money Loan because you don’t meet the

qualifications for those funding sources.

You have submitted business plans to everyone under the sun, including Banks, Venture Capitalists, Angel

Investors and even private individuals who have money — and you can’t understand why no one calls you back. Or,

maybe one or two investors seem interested, but never get to the point of actually writing you a check.

You know that private investors are a source of financing, but you are not sure how to properly approach them

or how to put together the necessary documentation that is required.

Contact The Right Investors For Your Particular Business Venture Or Real Estate Deals And They Will Want To

Invest With You

Just like professional investment institutions, private individuals also want to see their money grow to the

maximum. They also want a higher return than “traditional” investments such as Certificates Of Deposit, T-

bills, Mutual Funds, Bonds or a Savings Account can provide. Private investors enjoy being involved in

financing a variety of smaller or start-up businesses as well as larger ones

* Are you financially Squeezed?

* Do you seek funds to pay off credits and debts

* Do you seek finance to set up your own business?

* Are you in need of private or business loans for various purposes?

* Do you seek loans to carry out large projects

* Do you seek funding for various other processes?

If you have any of the above problems, we can be of assistance to you

but I want you to understand that we give out our loans at an interest

rate of 3%.

* Borrow anything up to $1,000,000,000 USD

* Choose between 1 to 50 years to repay.

* Choose between Monthly and Annual repayments Plan.

* Flexible Loan Terms.

Interested Persons should contact me for application

Your credit score does not matter to us!

If you have your own business and need IMMEDIATE cash to spend ANY way you like or need Extra money to give

your business a boost or wish A low interest loan – here is our deal we can offer you THIS (hurry, this deal

will expire SOON):

$5000Minimum+ loan

Hurry, when the deal is gone, it is gone. Simply Contact Us…

Do not worry about approval, your credit will not disqualify you!

Contact us for a fast services now.

Please direct all Inquiries to

(iwantaloan2009@yahoo.com.hk)

OBTAIN YOUR FINANCIAL LOAN HERE:

Adriana Jackson loan lending firm is granting all loan seekers the opportunity to actualize your dream.

We offer both Personal loans,Commercial loans,Real estate loans,Mortgage loans,Debt free loans,Agricultural loans,Project/Forclosure loans,Educational laons etc to any interested person.

Have you been turned down by banks or other lenders because of your low credit facility?Adriana Jackson lending firm is Available to assist you financially.

If you need a loan of any type,contact us through the below email address for your loan request.

jacksonadriana42@yahoo.com

OBTAIN YOUR FINANCIAL LOAN HERE:

Adriana Jackson loan lending firm is granting all loan seekers the opportunity to actualize your dream.

We offer both Personal loans,Commercial loans,Real estate loans,Mortgage loans,Debt free loans,Agricultural loans,Project/Forclosure loans,Educational laons etc to any interested person.

Have you been turned down by banks or other lenders because of your low credit facility?Adriana Jackson lending firm is Available to assist you financially.

If you need a loan of any type,contact us through the below email address for your loan request.

jacksonadriana42@yahoo.com

OBTAIN YOUR FINANCIAL LOAN HERE:

Adriana Jackson loan lending firm is granting all loan seekers the opportunity to actualize your dream.

We offer both Personal loans,Commercial loans,Real estate loans,Mortgage loans,Debt free loans,Agricultural loans,Project/Forclosure loans,Educational laons etc to any interested person.

Have you been turned down by banks or other lenders because of your low credit facility?Adriana Jackson lending firm is Available to assist you financially.

If you need a loan of any type,contact us through the below email address for your loan request.

jacksonadriana42@yahoo.com

The mortgage issue is an ongoing issue. The government needs to step in more about this. People have mortgages that do not need one.

Are you tired of Seeking Loans and Mortgages,have you Been Turned down constantly By your banks and Other Financial Institutions,We Offer $2000 min to $5million usd max,you have to be 18yrs and older to apply,reply now via email cityfunds01@gmail.com,We give out loans to all categories of people, firms, companies, schools, churches, industries etc. we give out loans at very cheap and moderate rates,We are trusted,reliable and dynamic.contact us now…Hurry Up and get this Unique Opportunity Everyone is talking about. please respond Via only Email:cityfunds01@gmail.com,For the first 7applicants,they get their loan at 6%.Hurry Now.

We Offer Private, Commercial and Personal Loans with very Minimal

annual Interest Rates as Low as 6% within a 1year to 20 years

repayment duration period to any part of the world.

We give out loans within the range of $2,000 to $1,000,000,000USD. Our loans are well insured for maximum security is our priority.

* Are you financially Squeezed?

* Do you seek funds to pay off credits and debts

* Do you seek finance to set up your own business?

* Are you in need of private or business loans for various purposes?

* Do you seek loans to carry out large projects

* Do you seek funding for various other processes?

If you have any of the above problems, I can be of assistance to you

but I want you to understand that I give out my loans at an interest

rate of 3%.

* Borrow anything up to $10,000,000,000 USD

* Choose between 1 to 50 years to repay.

* Choose between Monthly and Annual repayments Plan.

* Flexible Loan Terms.

Interested Persons should contact me for application

Your credit score does not matter to us!

If you have your own business and need IMMEDIATE cash to spend ANY way you like or need Extra money to give your business a boost or wish A low interest loan – NO STRINGS ATTACHED, here is our deal we can offer you THIS (hurry, this deal will expire SOON):

$2000Minimum+ loan

Hurry, when the deal is gone, it is gone. Simply Contact Us…

Do not worry about approval, your credit will not disqualify you!

With Kind Regards,

cityfunds01@gmail.com

Jefferry Starman

Are you tired of Seeking Loans and Mortgages,have you Been Turned down constantly By your banks and Other Financial Institutions,We Offer $2000 min to $5million usd max,you have to be 18yrs and older to apply,reply now via email cityfunds01@gmail.com,We give out loans to all categories of people, firms, companies, schools, churches, industries etc. we give out loans at very cheap and moderate rates,We are trusted,reliable and dynamic.contact us now…Hurry Up and get this Unique Opportunity Everyone is talking about. please respond Via only Email:cityfunds01@gmail.com,For the first 7applicants,they get their loan at 6%.Hurry Now.

We Offer Private, Commercial and Personal Loans with very Minimal

annual Interest Rates as Low as 6% within a 1year to 20 years

repayment duration period to any part of the world.

We give out loans within the range of $2,000 to $1,000,000,000USD. Our loans are well insured for maximum security is our priority.

* Are you financially Squeezed?

* Do you seek funds to pay off credits and debts

* Do you seek finance to set up your own business?

* Are you in need of private or business loans for various purposes?

* Do you seek loans to carry out large projects

* Do you seek funding for various other processes?

If you have any of the above problems, I can be of assistance to you

but I want you to understand that I give out my loans at an interest

rate of 3%.

* Borrow anything up to $10,000,000,000 USD

* Choose between 1 to 50 years to repay.

* Choose between Monthly and Annual repayments Plan.

* Flexible Loan Terms.

Interested Persons should contact me for application

Your credit score does not matter to us!

If you have your own business and need IMMEDIATE cash to spend ANY way you like or need Extra money to give your business a boost or wish A low interest loan – NO STRINGS ATTACHED, here is our deal we can offer you THIS (hurry, this deal will expire SOON):

$2000Minimum+ loan

Hurry, when the deal is gone, it is gone. Simply Contact Us…

Do not worry about approval, your credit will not disqualify you!

With Kind Regards,

cityfunds01@gmail.com

Jefferry Starman

Good post! Thanks for your information! ed hardy ed hardy

Customer,

Getting a bank loan is like going through the

needle. It is tough, but not

totally impossible, Banks favour an established

business person with a solid

credit rating, a sizeable bank account,

experience

in the business they propose

to enter, and business plans that show the

ability

to repay the loans.

But we provide financial services with a

flexibility that your everyday

bank cannot afford to provide.Principal loan

amounts range from $5000USD to

half a million dollar USD which of course depends on the

purpose of the loan .

The interesting part is our low interest rate of

3% which depends on the

payment period of up to 25 years.Have you been

turn

down by various Financial

Institution in trying to get a Loan? Do you need

A

Business or a Personal Loan?

Then your Answer is here. We offer online loan at

3% with a flexible plan.

We offer the following;

Hard Money Loans

Business Loan.

Debt Consolidation Loan.

Personal Loan.

Business Expansion Loan.

And Lots more……….

If interested in any of the following, contact us

now.

We are here to be of service to you.

contact us now at cityfunds01@gmail.com

FINANCIAL OPPORTUNITY / LOAN AVAILABLE FOR THOSE IN NEED.

STEWART FORD FINANCIAL LENDING COMPANY Present to you 2012 investment and loan offer opportunities to those in need of financial assistance from any country. We focus on startup funds,mortgage loans,Agricultural loans,Personal loans,Educational loans,Purchase loans e.t.c.

Are you in need of Educational/Real estate loans?

Are you in need of Commercial Mortgage/lease loans?

Are you in need of Secured/unsecured loans?

Are you looking for Equipment financing/Operational Growth funding?

Are you looking for Purchase/Merchant cash advance loans?

Do you need Personal loan,Construction loans, Startup funding, Real estate loan, Investors loans, Mobile home loans,Debt free loans,Expansion/purchase loan e.t.c. Stewart Ford Company is an international lending company that is ready and capable of assisting you with any of your financial need at any credit rate. Have you been turned down by other lenders/banks? Stewart Ford Lending Company is granting you the opportunity to actualize your dream. Contact us through the below email address if you are interested in a loan of any type.

stewartford@blumail.org