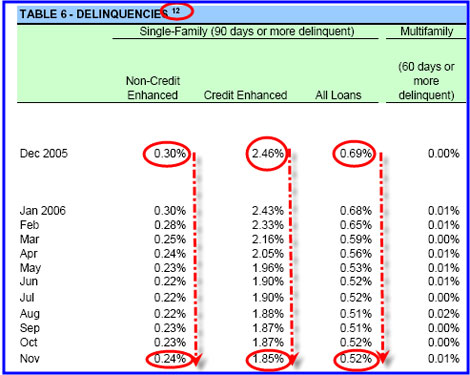

Shedlock (Mish) is convinced that mortgage delinquencies are rising, despite

finding this chart in a recent Freddie Mac report:

That’s Mish circling the footnote: he’s convinced that the explanation for

the drop can be found in the footnotes.

Essentially Footnote # 12 says that if Freddie Mac renegotiates the terms

of the loan with someone who is delinquent then "voila" that person

is no longer delinquent. It seems to me that since about June of 2006 Freddie

Mac is struggling to keep this ponzi scheme afloat.

Does Mish have any evidence that Freddie’s renegotiation rate is increasing?

No. And in fact, if renegotiation rates were increasing, that would

be great news for the subprime mortgage market. A lot of the subprime

crunch can be explained by the fact that up until recently, underwriting

standards were getting ever looser, which meant that borrowers in trouble could

always renegotiate rather than default. But if Mish is right – and he

cites a WSJ article by Ruth

Simon in support of his thesis – then in fact many subprime borrowers

might well be able to refinance their way out of trouble, rather than falling

into default and foreclosure.

The Simon article also notes an increase in "short sales":

The rise in bad loans also is leading to a pick up in so-called short sales,

in which a lender allows the property to be sold for less than the total amount

due and often forgives the remaining debt. For the lender, the process can

be shorter and less costly than foreclosing, especially in a declining market.

For borrowers, it is a way to avoid having a foreclosure on their credit report.

If such things are allowed, they’re much better than foreclosure for both borrower

and lender; it’s good news that these things are increasing despite the boom

in mortgage-backed securitizations (which you’d expect might make short sales

more difficult).

It seems to me that the market is actually doing a very good job, so far, of

coping with developments in the mortgage sector. MBS prices for 2006-vintage

subprime loans are down, and underwriting standards are getting tighter, as

you’d hope and expect – but at the same time, overall delinquencies are

falling, not rising, and lenders are being constructive when it comes to relations

with distressed borrowers. A massive credit crunch is by no means a foregone

conclusion.

“It seems to me that the market is actually doing a very good job, so far, of coping with developments in the mortgage sector.”

You got to be kidding, right?